Filecoin Network Value drivers

Tokenomics: How do you value Filecoin?

Many investors are considering adding cryptocurrencies to their portfolio, or even increasing their allocation. At the same time, crypto prices have been volatile. So investors are naturally asking the question: ‘What is it [Bitcoin, Ethereum, Filecoin, etc.] really worth’?

There are no textbooks on valuation in the digital asset space. But that doesn’t mean that valuing digital assets is impossible. It just requires a different lens, new models, and a new way of thinking about how value can be captured.

‘Utility tokens’ are one type of cryptocurrency that are surging in popularity because they benefit both users and investors simultaneously. In this article we will walk through some frameworks that can help us value one type of token, FIL, the cryptocurrency underpinning the Filecoin network.

Filecoin is a decentralised cloud platform that is set to become the ‘Airbnb’ of cloud storage (Like Airbnb, Filecoin lets you rent out storage space on your computer).

The framework will help investors to not only value Filecoin, but to value other crypto assets – many of which have similar dynamics. Having a fundamental framework like this should help investors be more comfortable allocating to crypto assets.

The tokenomics of Filecoin

Tokenomics is a term used to describe the ‘economic model’ (business model) of new digital assets. Blockchain theorist and strategist William Mougaya defines a token as

A unit of value that an organization creates to self-govern its business model, and empower its users to interact with its products, while facilitating the distribution and sharing of rewards and benefits to all of its stakeholders.

FIL is the native currency of the Filecoin blockchain. FIL is used as the economic incentive within the filecoin economy. The protocol itself rewards those who provide storage capacity to the network.

Like many digital assets, FIL fundamentally has value because of supply and demand forces, which makes it akin to a commodity.

Below we look at the forces of demand and supply for Filecoin.

Filecoin’s demand side

Demand for Filecoin comes from three key actors:

1. Storage miners

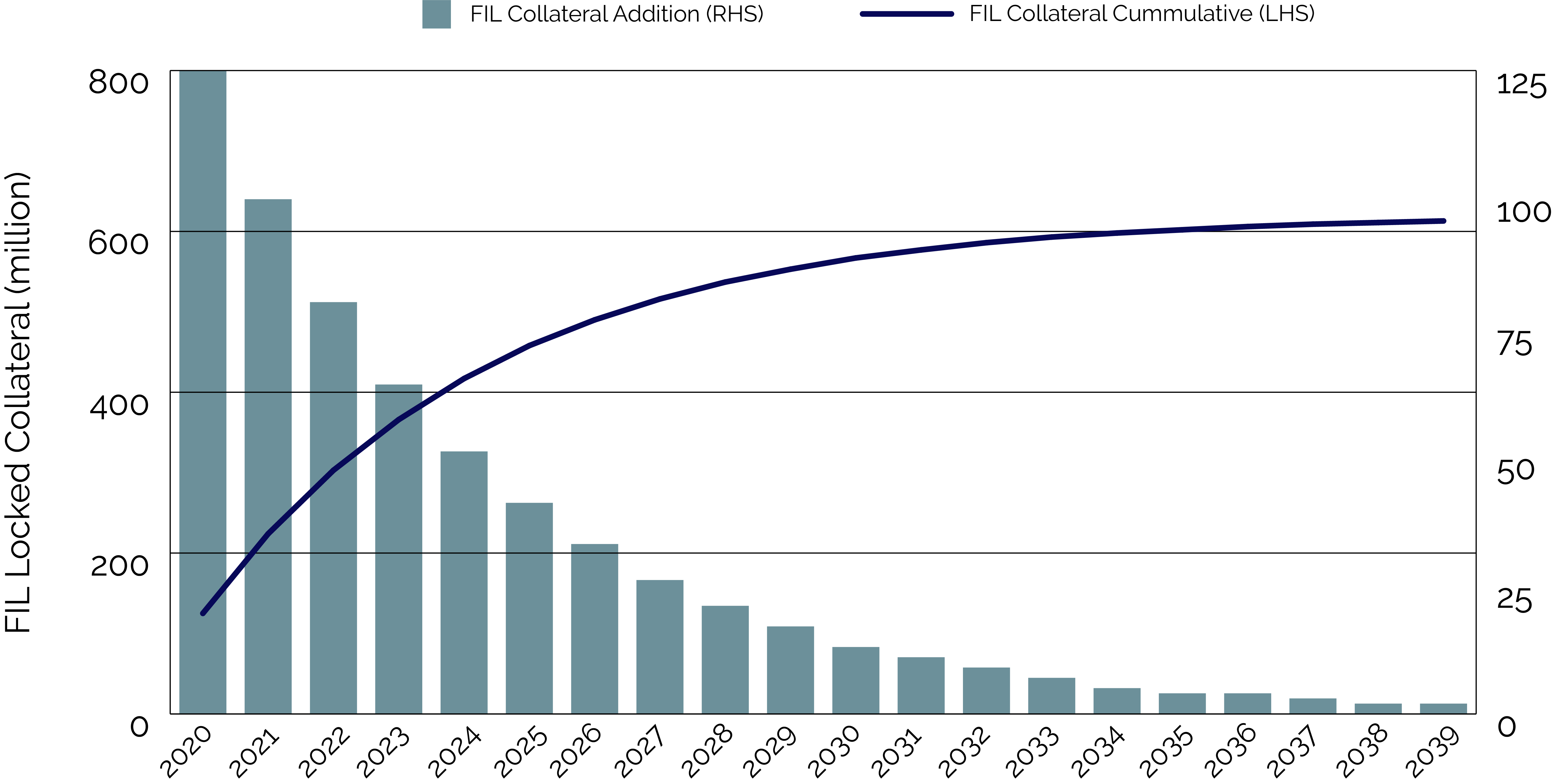

Storage miners – who earn filecoin by storing data for clients – provide the infrastructure for the Filecoin ecosystem. To ensure incentives are aligned for the long term, the Filecoin system forces storage miners to put up collateral in FIL.

Using the current collateral requirements, and making some assumptions around the growth of the network, we can estimate the amount of FIL that storage miners will lock up.

FIL Demand from Storage Miners

2. Customers

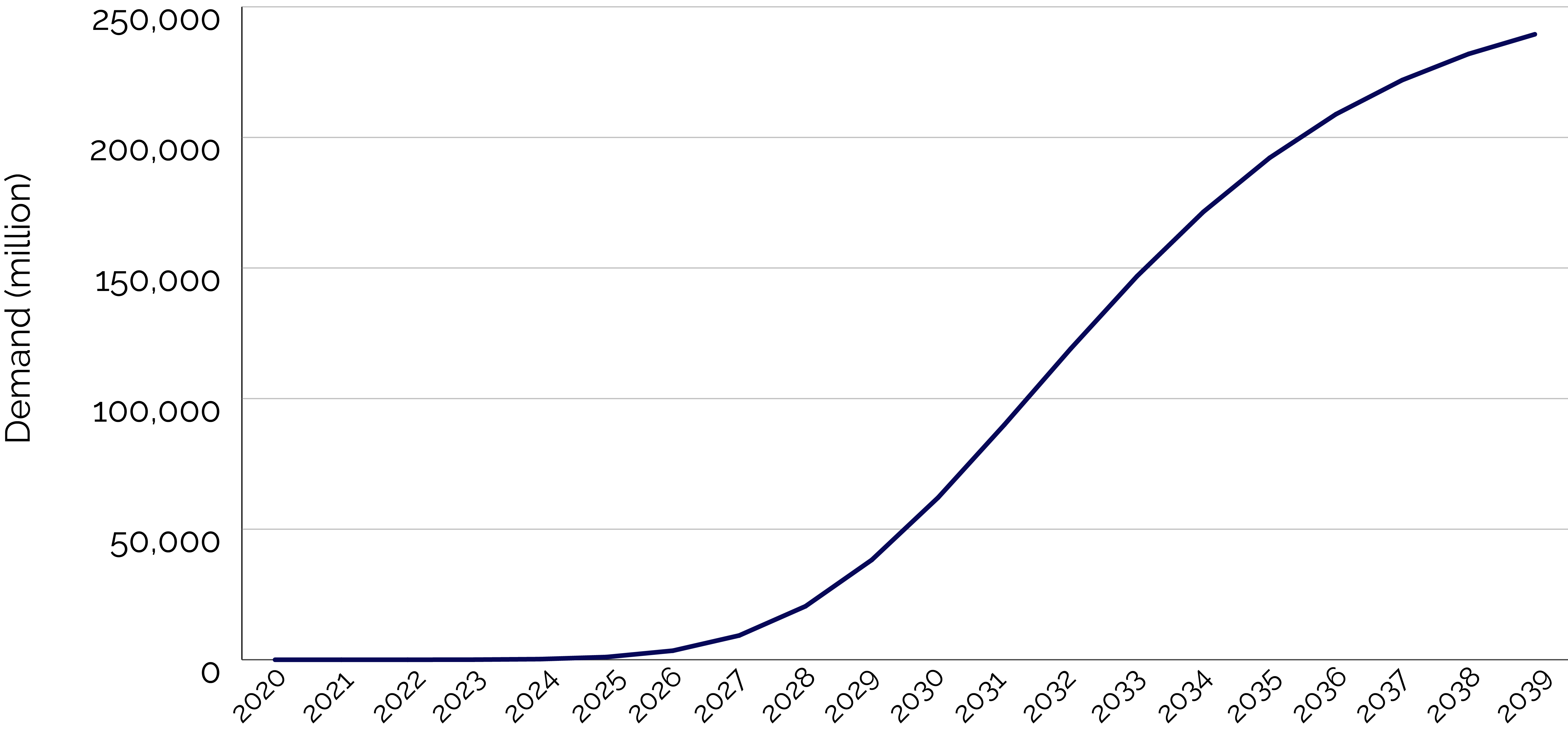

Logically the demand for FIL should and will come from the customers. Customers who want to use filecoin storage (and in later years Filecoin Retrieval) systems will need to acquire FIL to pay for their ‘storage contracts’.

Filecoin offers a unique value proposition to users (outside of the centralized incumbents). And because of the heavily subsidized contracts, the costs are substantially cheaper. That makes it a great option for cheap, long-term storage (archival storage). For example, Filecoin contracts are approximately 3% the cost of Amazon Web Services (AWS) Glacier Deep archive storage. If customers are storing the data for long intervals, the cost savings start to become very compelling, particularly for large datasets.

Projected Demand of Filecoin (USD)

Understanding the Filecoin demand from customers overtime is difficult to predict but there are key factors. One is the size of data storage demand. We are fast entering an artificial (AI) and internet of things (IOT)-enabled world where the demand for data is almost endless. We need far more and far cheaper solutions for data storage than we have today: likely 100x cheaper than today. The demand in USD terms will translate into FIL demand.

3. Investors

Investors will also play a key role in the demand for FIL. In the initial stages of network development much more of FIL will be held by investors given the potential reward. Overtime, FIL should transition to user’s of the Filecoin platform with the price being determined by the supply and demand for FIL. The price of FIL should reflect the value of the Filecoin network over the long term, making it more stable and thus less attractive to investors.

Still, there will always be some FIL held by investors, and FIL will be able to be lent (likely to miners) with the investor earning a yield.

Filecoin’s supply side

1. Supply minted

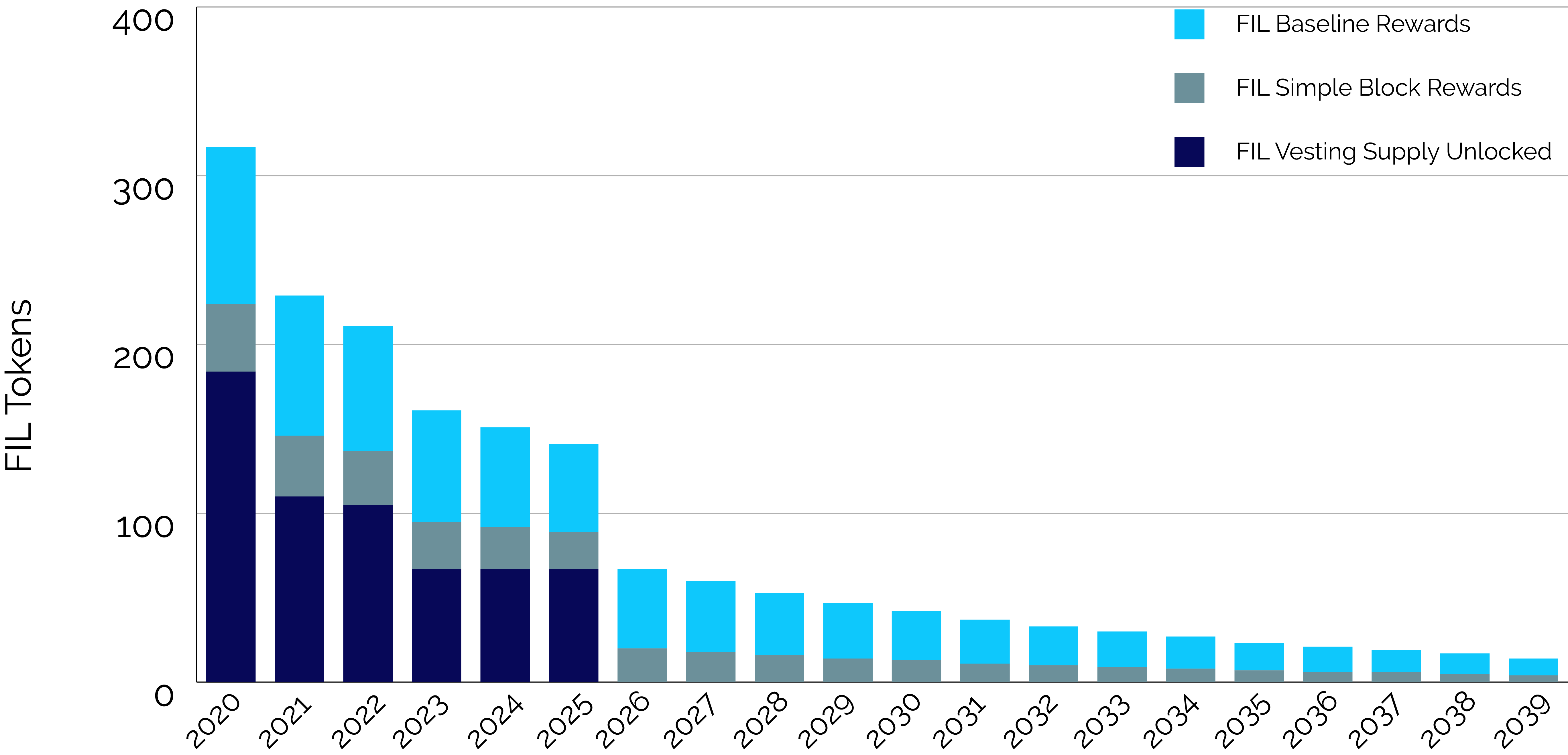

The supply of FIL into the market comes from the FIL bought by early investors. Their FIL is on a vesting schedule. FIL is also released from the blockchain to miners via ‘Block rewards’. Block Rewards are the incentive mechanism to encourage the build-out of infrastructure of the Filecoin network.

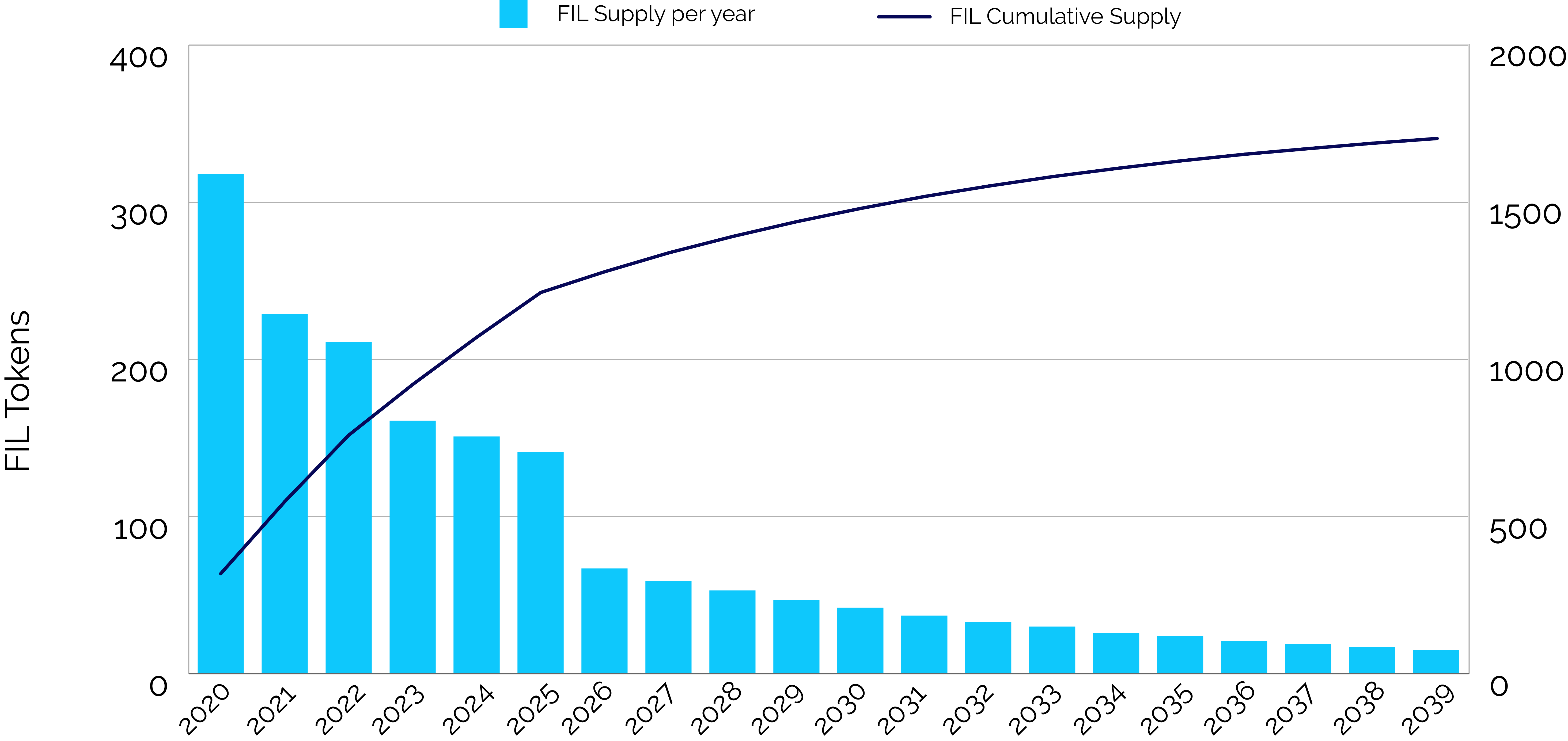

The graph below shows the supply released annually should the network hit 100% of its KPI (baseline rewards). If the Filecoin network doesn’t hit 100%, the rate of supply will slow. For our analysis we assume that it does.

FIL Supply dynamics

This equates to 1.7 Billion FIL that can potentially come onto the supply of the market (an additional 300k is set aside for further incentives should they be needed in the future).

FIL Projected Supply

2. Supply Burned

The removal of FIL from the supply is one of its defining features as an investable asset. Filecoin has introduced EIP-1559 (Ethereum Improvement Proposal) which introduces a fee-burning mechanism that permanently removes coins from the total circulating supply of FIL.

Whilst the fee mechanism is designed to solve a UX problem of predictability of transaction fees, particularly as the network becomes congested, it has an added benefit of driving scarcity for the underlying asset which benefits all existing users (FIL holders). As the utility of the Filecoin network increases, so will the transactions on the network. The more transactions there are, the more FIL is burned in the process.

In the last 10 days the Filecoin Network has burned over $500,000 worth of FIL. Notably, this is well under what the network has done since it started in October 2020. This puts it on a run rate to burn $200 million worth of FIL in its initial year.

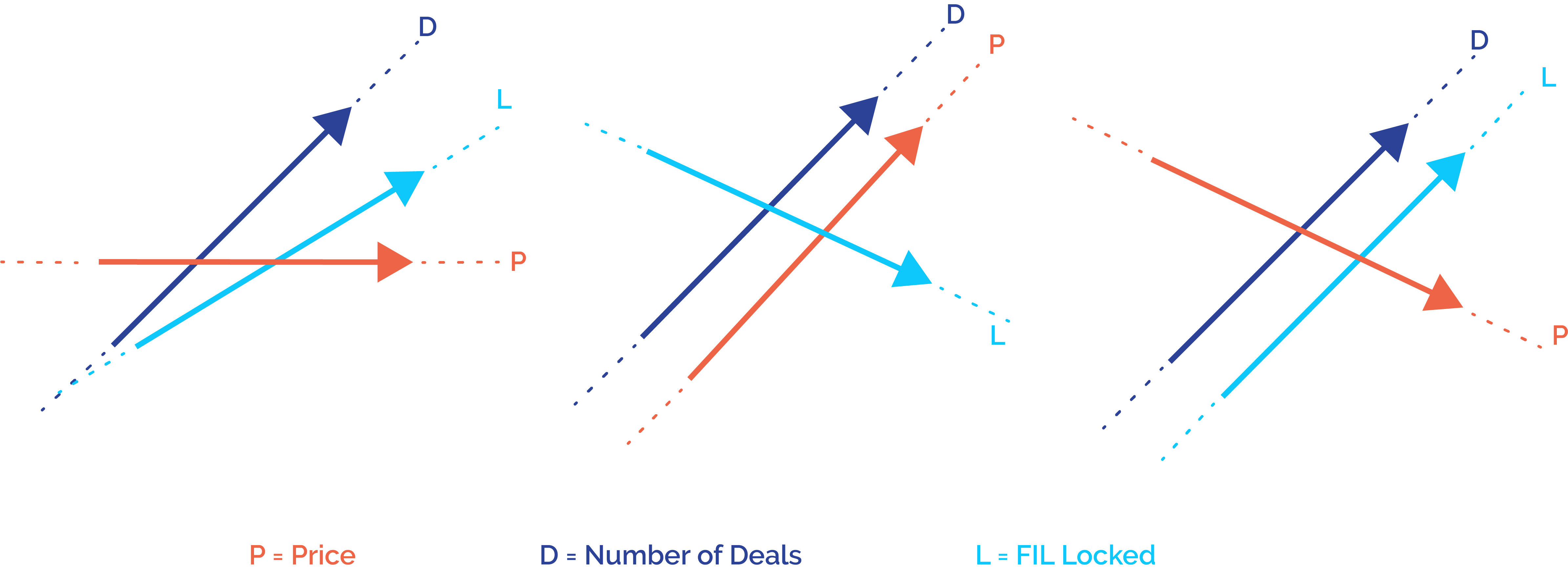

Understanding price dynamics

There are price dynamics that create a somewhat stabilising effect of the FIL price over the long term. When the price of FIL is declining, more FIL is required to make a storage contract in equivalent USD value – thus more FIL is locked up over time. This creates supply pressure on the coin supply, driving upward price pressure over time.

Conversely, when the price of FIL is rising, less FIL is required to make a storage contract in equivalent USD value. This reduces the FIL locked up in collateral on deals over time, allowing the supply of FIL from previous deals to come back onto the market.

Ultimately, this creates a self stabilising protocol that makes for a more stable asset price in the long term that is correlated to the value of the network.

A simpler task

Understanding the value of FIL is difficult, but understanding the components that impact supply and demand of the network is a simpler task. More work is being done at Holon to understand how these forces combine and can be used to project out the price of FIL, given some basic assumptions around the USD demand for Filecoin.

Regardless, the above should contextualise how demand for the Filecoin protocol (value proposition) directly relates to the price of FIL, and that price should, over time, stabilise and be representative of the entire network value.