Filecoin in 2023: Expectations, milestones and opportunities

In the words of Jeff Bezos. Ouch.

Filecoin, the open-source, public cryptocurrency and data storage digital payment system – declined approximately 90% in value over the course of 2022. This is equivalent to Amazon, who after the tech wreck in 2000 similarly fell ~90%.

While there are some similarities between them today (they both provide some form of internet services), they are also extremely different. Filecoin is no company after all – thus it requires a more nuanced approach to understand how value is created for the underlying digital asset (FIL) and thus for asset holders.

However, this can be simplified: the value of Filecoin in 2023 – or FIL – is a function of the value that it provides to two parties:

-

- Customers; and

- Asset holders

Like any company it must provide a valuable service/product to customers first and foremost and then secondly to asset holders.

Amazon redirects profits from their service not to dividends but share buybacks. (Although, some may be surprised to know that this year was the first time Amazon bought shares back since 2012). Through purchasing shares, they remove supply of Amazon shares which indirectly makes the existing shares more valuable.

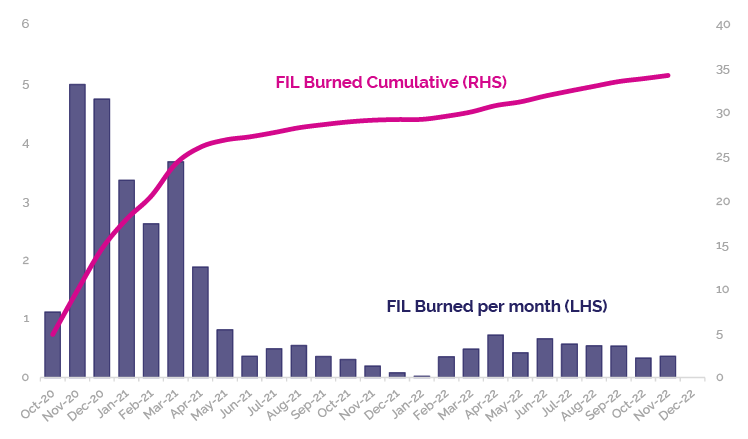

Filecoin has a similar mechanism, as every transaction on FIL incurs a fee. Part of that fee is ‘burned’ (removed from supply permanently), like a share buyback. You can see the amount of FIL being burned from Figure 1 below.

Fig 1: FIL burned, October 2020 – October 2022 (millions)

Source: starboard.ventures

Source: starboard.ventures

This indirectly makes the existing FIL more valuable – so why the big price drop?

The amount of FIL burned is only relevant to the amount of FIL being issued. Like stock-based compensation, or a company issuing new shares to raise capital, the FIL being burned is only part of the information required. The takeaway here is that there is a mechanism in which value is captured by holders if the Filecoin network provides value to a lot of customers. More transactions and more adoption of Filecoin in 2023 will translate to more burn.

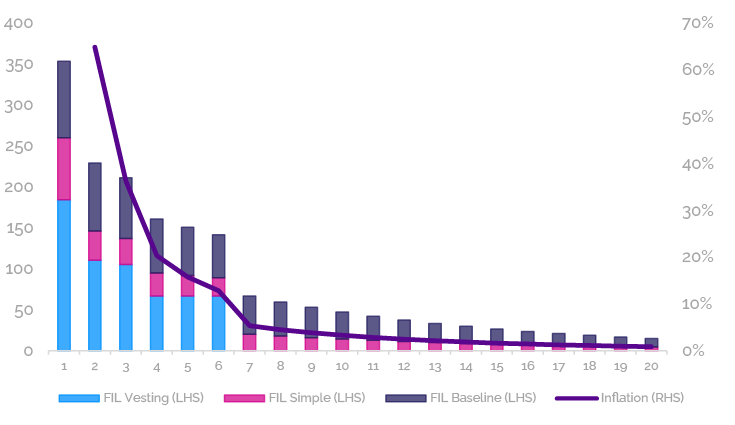

Turning to the issuance of FIL – while this was (or should have been) largely understood, the issuance of FIL has become more controversial amongst the cryptosphere as the price decline has continued through 2022. At a high level, the issuance of FIL can be broken into three distinct categories:

-

- Vested FIL – The FIL being issued to early investors over a pre-defined vesting schedule

- Simple FIL Minting – A fixed amount of FIL issued to those providing storage services on Filecoin network

- Baseline FIL Minting – A variable amount of FIL that is determined by an effective KPI of the network and also issued to those providing storage services on the network

Figure 2 below shows the issuance if the network achieves 100% of its KPI throughout the first 20 years.

Figure 2: Supply schedule of FIL at 100% of baseline (millions)

Source: Holon

Approximately 550 million FIL have been unlocked since the network’s inception (October 2020), thus 6% of the current FIL in supply has been burned. There is clearly a lot of FIL supply coming onto the market that the market must absorb. This is heightened when you consider the price throughout the initial year (An average of USD$64).

The decline in price can be part attributed to this over-supply. It’s not the only factor, the macro environment has created a very pessimistic environment for digital assets which doesn’t help the cause. Whilst the inflation rate is high (65% this year), we believe there are three important factors to remember:

-

- The inflation is stemming from early investors who funded the team (Who are now likely underwater on that investment).

- That the rest of the inflation is largely due to those providing value to clients and the network – a prerequisite for the Filecoin network to have any value at all.

- Long term, there is a limited supply of FIL in the market and if the network proves valuable it will lead to a deflationary asset as described earlier.

Those early Investors therefore should consider how they can combat that yield in the short term, i.e. lending markets amongst storage providers for FIL, as collateral is approximately 20% p.a. at the moment.

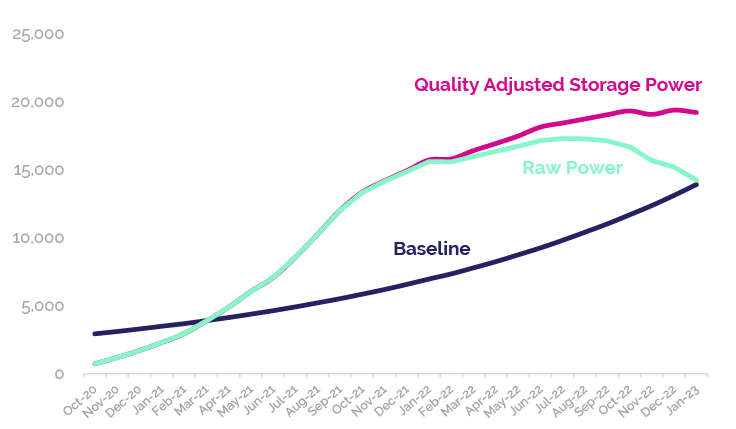

We suspect more accessible lending options will come online in 2023. It is also likely that, during 2023, we will see this inflation rate slow; in Figure 3 below the baseline minting (blue) is determined by the network’s “KPI”. Figure 3 also shows the network is slowing while the baseline continues to grow at a very rapid rate.

Figure 3: Entire network adjusted, raw and baseline power in PiB, October 2020 to January 2023

Source: starboard.ventures

With that in mind one of the main questions we’re hearing at the moment is, “When will the FIL price turn around?” The best path to an educated guess is to look at some of the activity that is occurring on the Filecoin network – that unfortunately many people miss – and gain insights into some of the fundamental changes on display and how that might impact price.

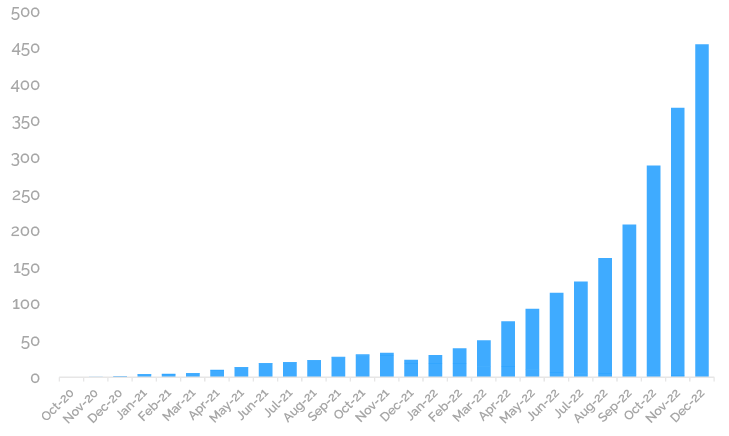

Client adoption and Storage provider collateral requirements

Filecoin has seen an explosion of client deals over 2022. As the price has fallen, the incentive to attract Filecoin Plus deals (a program that incentivizes the storage of “useful” data in the network, offering 10x potential block rewards) has accelerated, reaching close to 500PiB (Figure 4 below). The forecasts suggest we should see this reach over 1,500 PiB by the end of 2023.

Figure 4: Size of Filecoin clients deals, October 2020 – January 2023 (PiB)

Source: Holon

As more client data onboards the need for collateral to be locked up also increases. Further on, it looks as though the Filecoin community will be pushing through an economic upgrade that will further incentivise Storage Providers to lock up FIL for longer periods of times (FIP Discussion). As more FIL is locked, the supply in circulation will be reduced.

“This year we are going to see two other core services on Filecoin come alive.”

Moving across and up the value chain

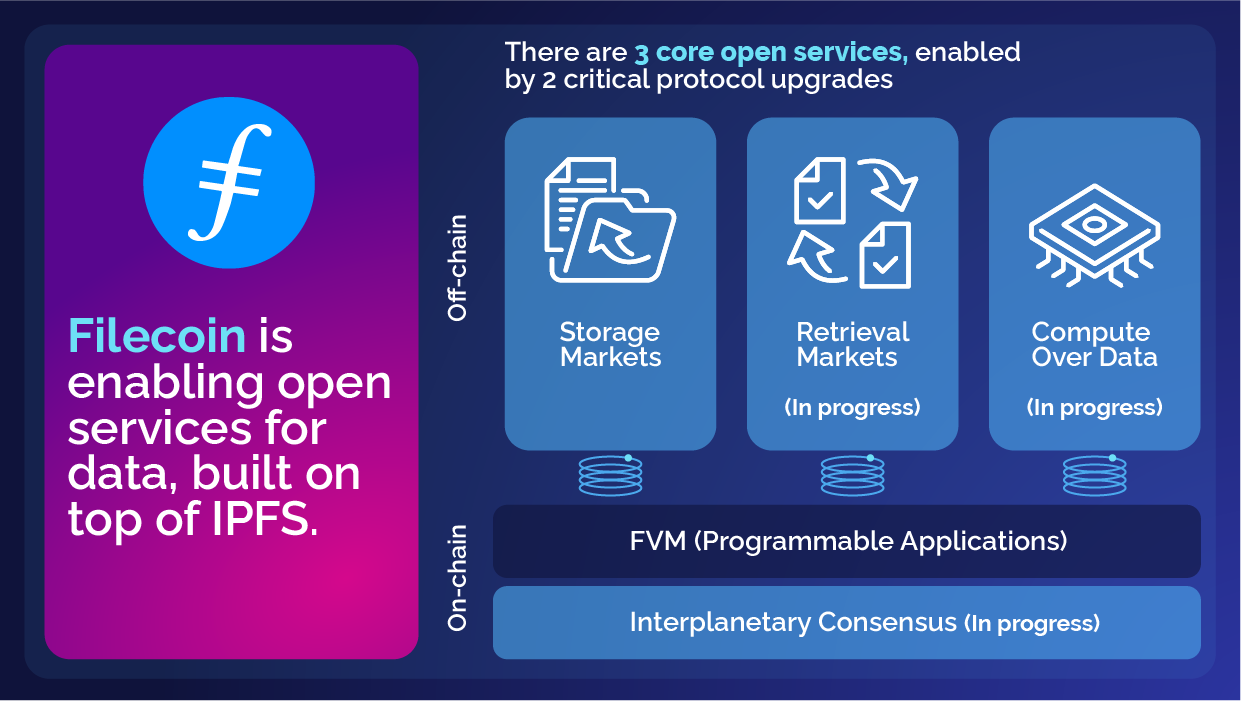

Much of the focus regarding Filecoin is around storage, but Filecoin in 2023 is a much more complex protocol than that. Storage Markets are just the initial step and where Filecoin’s focus is today. However, for Filecoin’s network to become truly valuable it must provide services beyond just storage. This year we are going to see two other core services on Filecoin come alive: Retrieval Markets (moving data around) and Compute Over Data (Figure 5 below).

Figure 5: Filecoin services

Source: https://twitter.com/duckie_han/status/1618276932008955904?s=20&t=KXTD7Z0erO9grolPPRY8MQ

Source: https://twitter.com/duckie_han/status/1618276932008955904?s=20&t=KXTD7Z0erO9grolPPRY8MQ

The combination of these core services will start to appeal to a much wider audience. Coupled with the Filecoin Virtual Machine (a smart contracting platform), it will be the introduction of unique features that cannot be replicated in legacy cloud environments.

For example, DataDAO’s can own and govern datasets, earning income that, in turn, can fund perpetual storage contracts, or potentially, in the case of scientific datasets, further research. We are keenly watching what applications emerge from the Filecoin Virtual Machine.

Thus, as more FIL is locked up as collateral, or burned via transaction fees, and the utility of the network starts to appeal to more clients, the supply vs demand equation will start to shift and reorientate to better reflect its value proposition. This is the opportunity for Holon in 2023.

Watch this space, and as the year unfolds, we will be here to unpack it all for you.

Disclaimer: This Article has been prepared by Holon Global Investments Limited ABN 60 129 237 592. Holon Global Innovations Pty Ltd (“HGI”) is a wholly owned subsidiaries of Holon Global Investments Limited (together “Holon”). HGI is a Filecoin (FIL) Storage Provider and is positioned as a major player in the FIL decentralised data storage arena for Asia Pacific. FIL Storage Providers are rewarded in FIL for the provision of data storage capacity. Holon, its officers, employees and agents believe that the information in this material and the sources on which the information is based (which may be sourced from third parties) are correct as at the date of publication. While every care has been taken in the preparation of this material, no warranty of accuracy or reliability is given and no responsibility for this information is accepted by Holon, its officers, employees or agents. Except where contrary to law, Holon excludes all liability for this information.