The ABCs of FIL – alignment, bootstrap and capture

An excerpt from The Holon Data Report, Part 6

For Web 3.0 to reach its potential, it must operate at a significantly greater scale than what it does today. Tokenomics can be critical in this regard by helping bootstrap a network effect, aligning incentives and driving value back to all stakeholders.

For clarity, Tokenomics is akin to the designing of a business model. The key to the token economy’s design is the structuring of incentives to reward and maintain behaviours that add value to the network, and devising subsystems that translate the network value to the token value.

What is FIL?

Blockchain author and strategist William Mougaya defines a token as, ‘A unit of value that an organization creates to self-govern its business model, and empower its users to interact with its products, while facilitating the distribution and sharing of rewards and benefits to all of its stakeholders’.

Filecoin introduced FIL as the native currency/token of the Filecoin blockchain, and has engineered an economy around FIL:

- It is earned by Storage Providers for reliably storing data over time.

- It is used as a form of payment for services, including for fees to send messages and transactions across the network.

- It is used as collateral by Storage Providers to provide an incentive to store data reliably over time.

- FIL is used for network governance, allowing FIL holders to vote on proposals and make decisions that impact the future development and direction of the network.

The Filecoin Network’s vision is ambitious and broad. It requires an enormous amount of coordination globally, and FIL is that coordination mechanism. For that to work, FIL must be valuable, below we look at how value is created in FIL by first exploring what value is and how it is captured. We then take a dive into the drivers of FIL value by looking at the supply and demand dynamics of it. This will give the reader a strong understanding of the Filecoin economy.

What is value?

In 1602, The Dutch East India Company (VOC) announced the world’s first IPO, making the purchase of its shares available to the general public. The original charter for the company asked investors to lock up funds for 21 years. This was a far stretch given at the time most companies were set up for one trade route and dissolved after a successful voyage, usually within four years. As the IPO neared, the terms were changed to ten years to further encourage investors, with the charter including an extra provision: ‘Conveyance or transfer (of shares) may be done through the bookkeeper of this chamber.’

The shares were free to be publicly traded, the first of its kind. It was not until 1610, that the VOC issued its first dividend, alas not in cash but in spice (mace). Value had been created for the investor, and while the medium in which the value was derived is questionable, the act of value transfer is not. However, for the discerning investor how was one to value the company? The company did not issue financial reports arguing that ‘shareholders wouldn’t be able to fathom the numbers anyway’.

The first equity valuation techniques used were dividend yield and book value, reflecting early equity investors’ perception of shares as quasi-bonds, differing only from bonds in the uncertainty of their maturity and of their dividend payments. Over the course of the next 400 years the techniques to understand the value of a company have changed considerably and even varied from region to region. These techniques often reflect new understandings of value creation, new technological advances, new business models and often the market environment at the time.

Blockchain and cryptographic tokens represent another shift in our understanding of value. As cryptocurrencies become more essential to society, their role as an asset class will increase and their presence in portfolios will too. It’s important therefore that we continue to analyse their value.

The concept of value is a deeply complex topic that traverses many fields and has a rich history of thinkers trying to understand how it is created and who is creating it. Value has many definitions but at the heart of value is the production of new goods and services.

In the mid-19th century, the concept of value seemingly reversed. The belief prior was that the value of products was derived by the amount of labour that went into them and which in turn determined price, this idea slowly switched to the belief that the price willing to be paid by an individual determined the value, i.e., the value was in the eye of the beholder. Value is without doubt a philosophical concept and as dynamic as the techniques used to measure it.

Value can be used interchangeably with wealth but maybe a more nuanced idea is that taken by Mariana Mazzucato in her book ‘The Value of Everything’, which is to consider value the process by which wealth is created – it is a flow.

In a business sense, it is also a balance. A business must balance the creating and taking of value = an imbalance can destroy wealth. In the 1970s, maximising shareholder value (MSV) grew in popularity as investors demanded a focus on profitability and efficient capital allocation. However, the narrowed focus of this is evident when you consider that a company is valuable because of a collective effort by many stakeholders: employees, customers, suppliers, distributors and the broader community; they all influence the success of a company’s market value. The latter of which does not often benefit at all from the production of the goods or services. It is this line of thinking that has given rise to a more wholistic view of value.

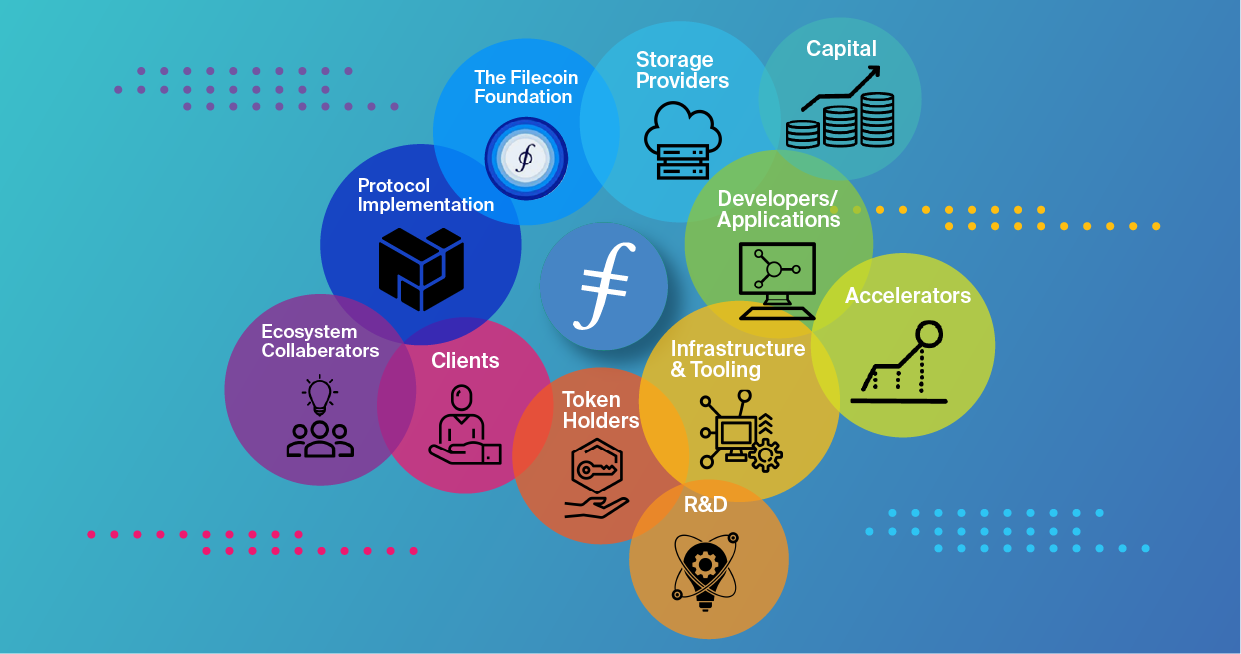

Environment, social and governance (ESG) investing recognises that there are often more complex relationships between all the stakeholders and that a company’s value is related to the success of the social relationships between them. Filecoin and many other cryptocurrencies are interesting in this regard as they by nature typically share any value between these various entities that participate on the open-source protocols. Burn mechanisms, where the token is permanently removed from the supply help in converting that value created by these entities, capturing it into the protocol itself.

In summary, if Filecoin as a collective of all its operators (Figure 1) can create services that provide a strong value proposition to clients, while capturing value through a mechanism like a burn, then over time FIL should start to reflect that value – it is a flow.

Figure 1: The Filecoin ecosystem

Source: Holon

Source: Holon

The tokenomics of FIL

Fundamentally, the value of cryptocurrencies like FIL arises from supply and demand dynamics. In the short term, FIL’s price may mirror trends in the broader crypto market (in particular Bitcoin). However, as time progresses, the unique tokenomics of Filecoin will play a more significant role, diminishing its correlation with the general market and reflecting the intrinsic value of its network. This will be accelerated by the network maturing and becoming better understood by the market.

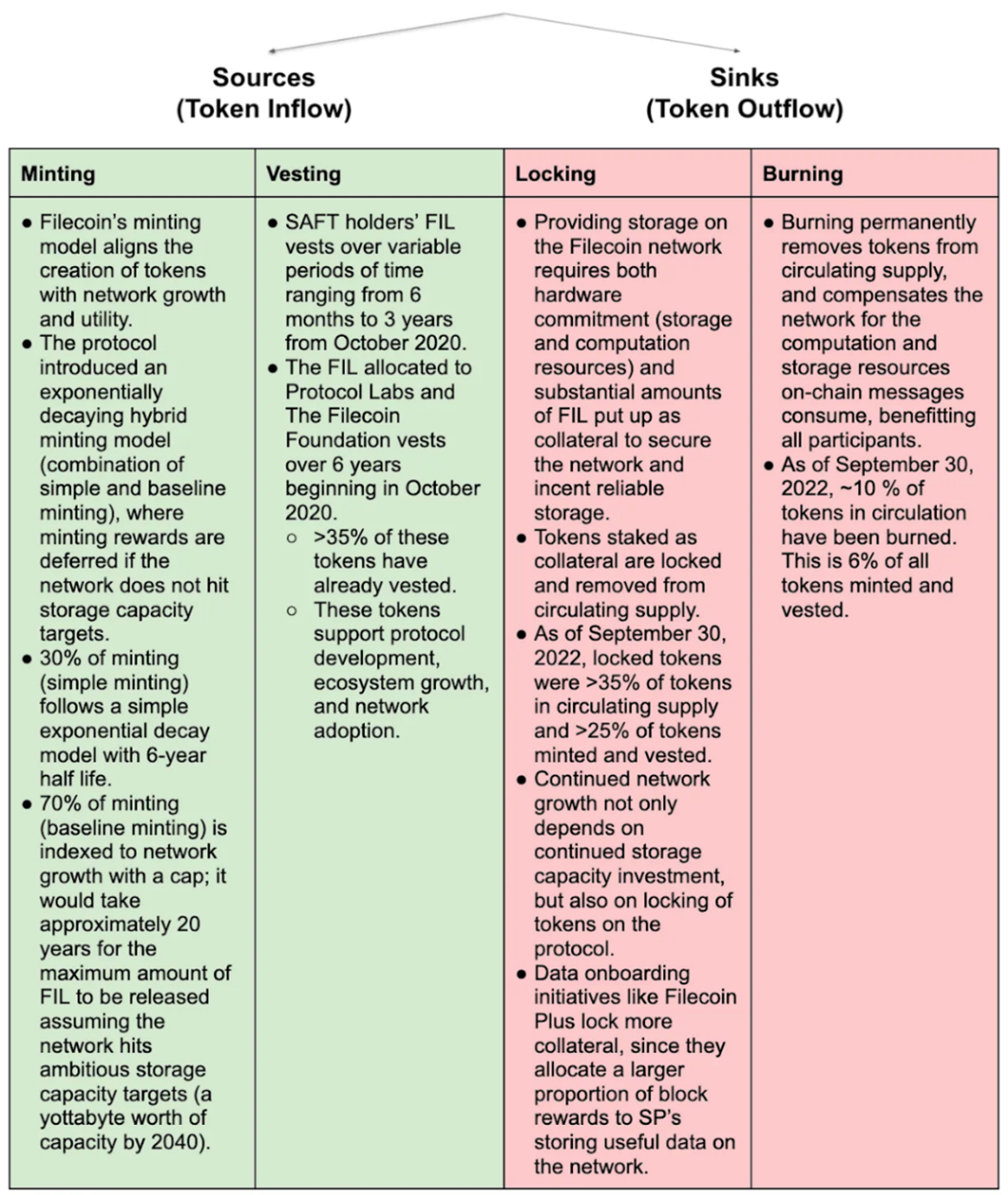

To grasp FIL’s tokenomics, one must first look at its initial distribution, followed by a deeper understanding of token circulation within its ecosystem and the ways various stakeholders and the token itself generate or capture value. Figure 2 offers a concise overview of these principles.

Figure 2: FIL Token Supply = Inflow – Outflow

Source: filecointldr.io

Source: filecointldr.io

The Holon Data Report Part 6, in its entirety, can be found here.

Disclaimer: This Article has been prepared by Holon Global Investments Limited ABN 60 129 237 592. Holon Global Innovations Pty Ltd (“HGI”) is a wholly owned subsidiary of Holon Global Investments Limited (together “Holon”). HGI is a Filecoin (FIL) Storage Provider and is positioned as a major player in the FIL decentralised data storage arena. FIL Storage Providers are rewarded in FIL for the provision of data storage capacity. Holon, its officers, employees and agents believe that the information in this material and the sources on which the information is based (which may be sourced from third parties) are correct as at the date of publication. While every care has been taken in the preparation of this material, no warranty of accuracy or reliability is given and no responsibility for this information is accepted by Holon, its officers, employees or agents. Except where contrary to law, Holon excludes all liability for this information.